Employee Loan Request

The Employee Loan Request feature allows employees to apply for loans through the system, providing a structured approval workflow that includes HR, Accounting, and General Manager reviews before finalizing the request. This feature helps ensure transparency and manage loan repayment directly through salary deductions.

Steps to Apply for a Loan

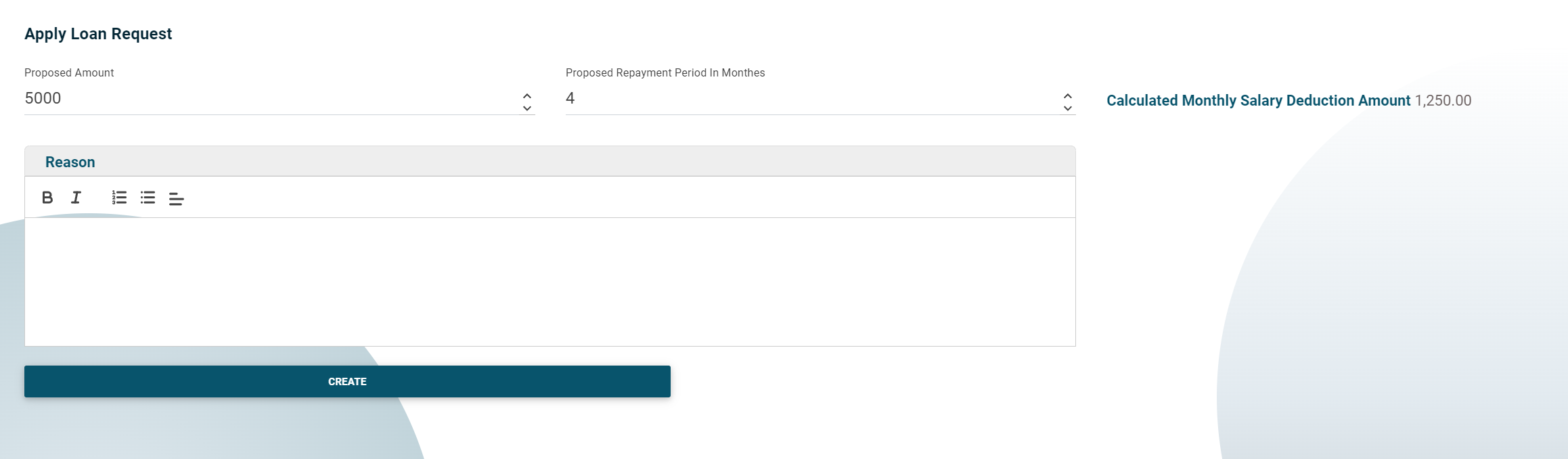

Employees can submit a loan request by following these steps:

- Access the Apply Loan Request under Accounting Menue.

-

Fill in the following fields:

- Proposed Amount: Enter the desired loan amount.

- Repayment Period: Specify the repayment duration in months.

- Reason: Provide a reason or justification for the loan request.

- Submit the application. The request is then forwarded through a multi-stage approval workflow.

Approval Workflow

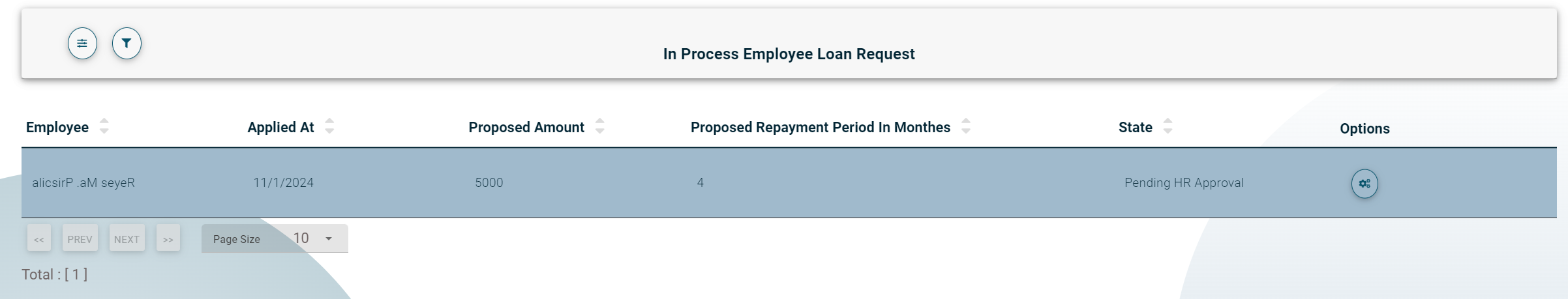

HR, Accountatn and General Manager will receive notification about the forwarded requests, or can check the (In Process Loan Requests) Page

- HR Review: The HR department reviews the application and chooses to approve or reject it based on internal policies.

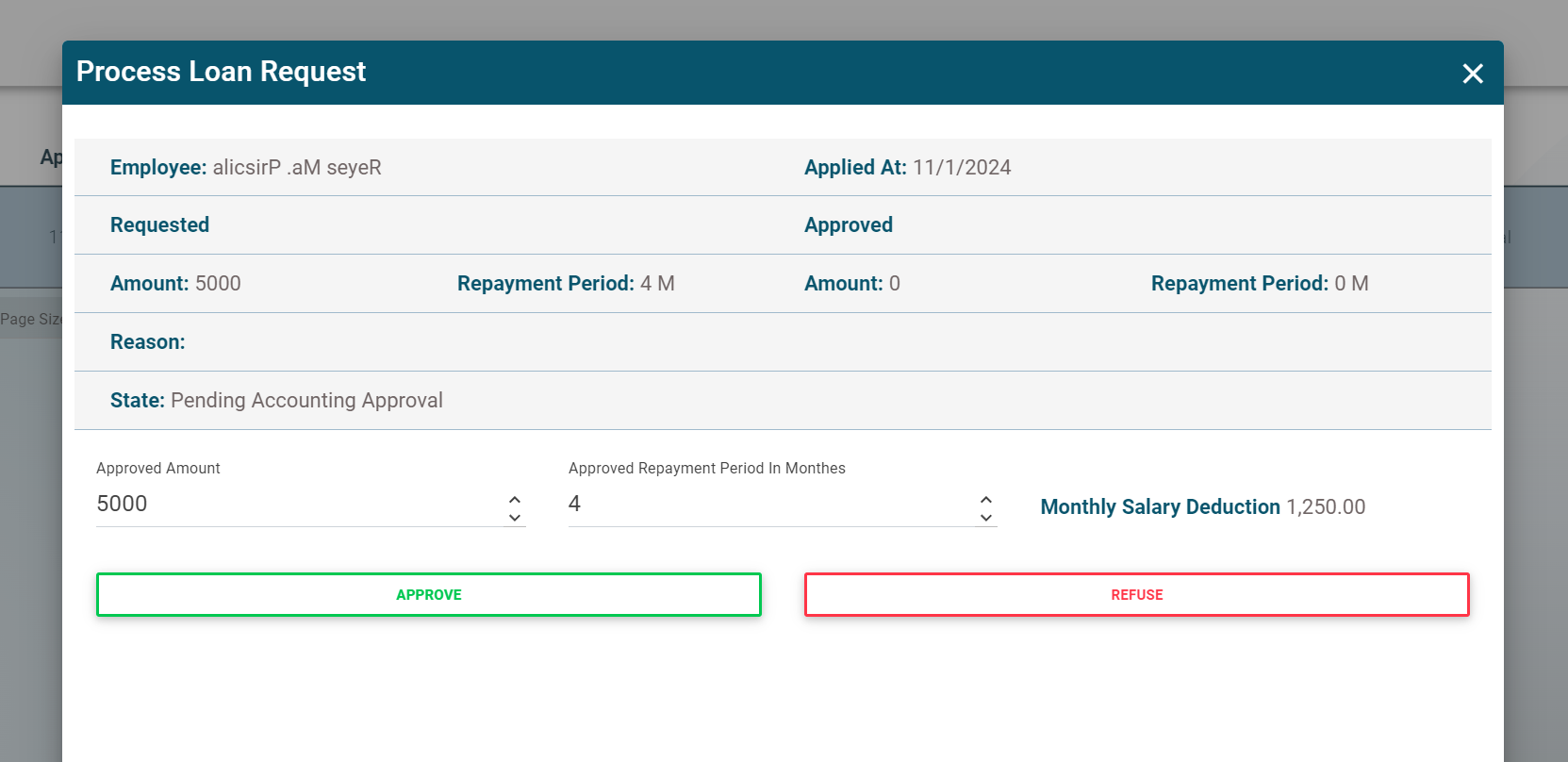

- Accounting Review: If approved by HR, the application moves to Accounting, where an accountant can:

- Approve or refuse the request.

- Specify the Approved Amount and Repayment Period if different from the proposed terms.

- General Manager Review: Once approved by Accounting, the request is forwarded to the General Manager for the final decision on approval or rejection.

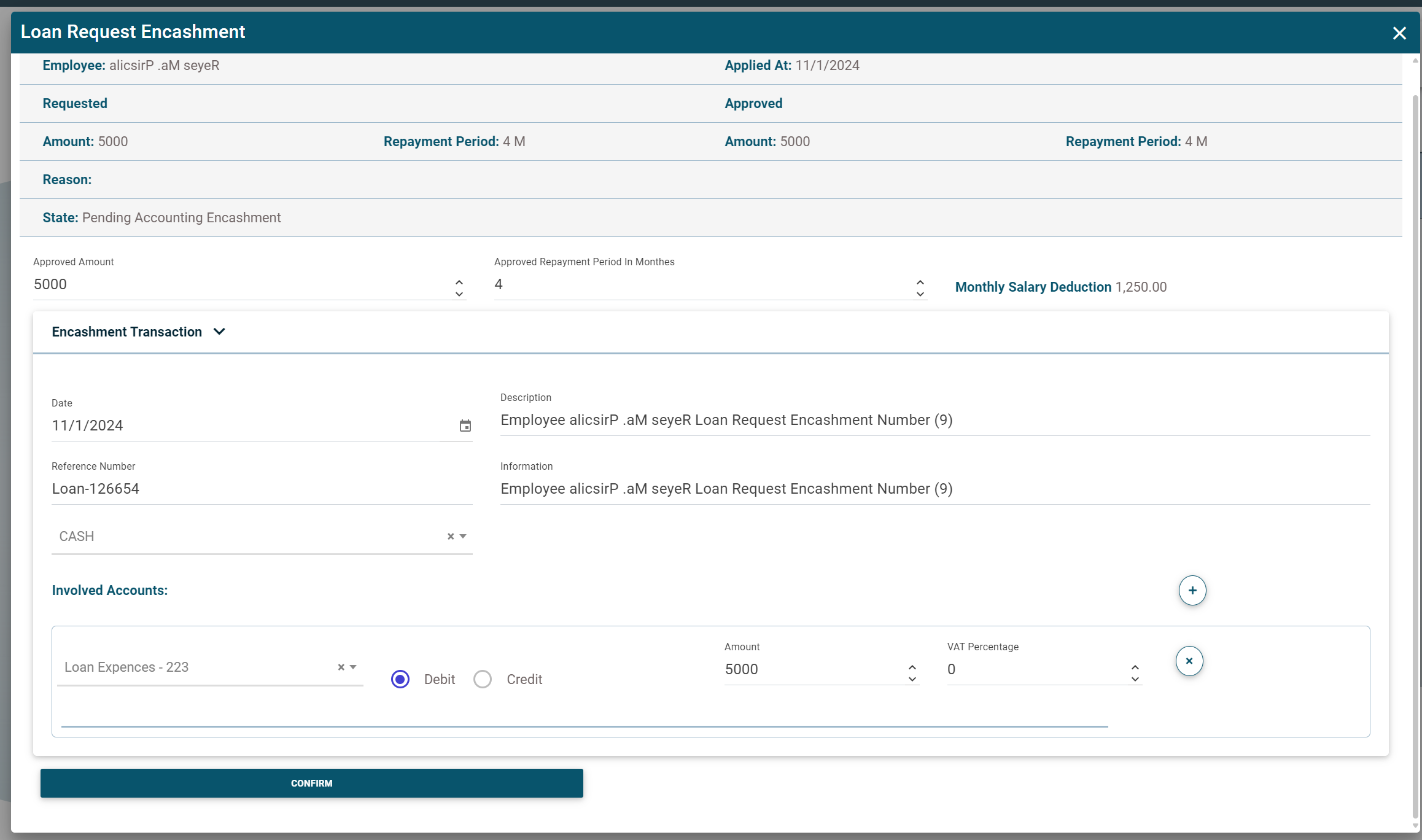

- Encashment: If the loan is approved by the General Manager, the application returns to Accounting for encashment processing, making the loan funds available to the employee.

Loan Repayment

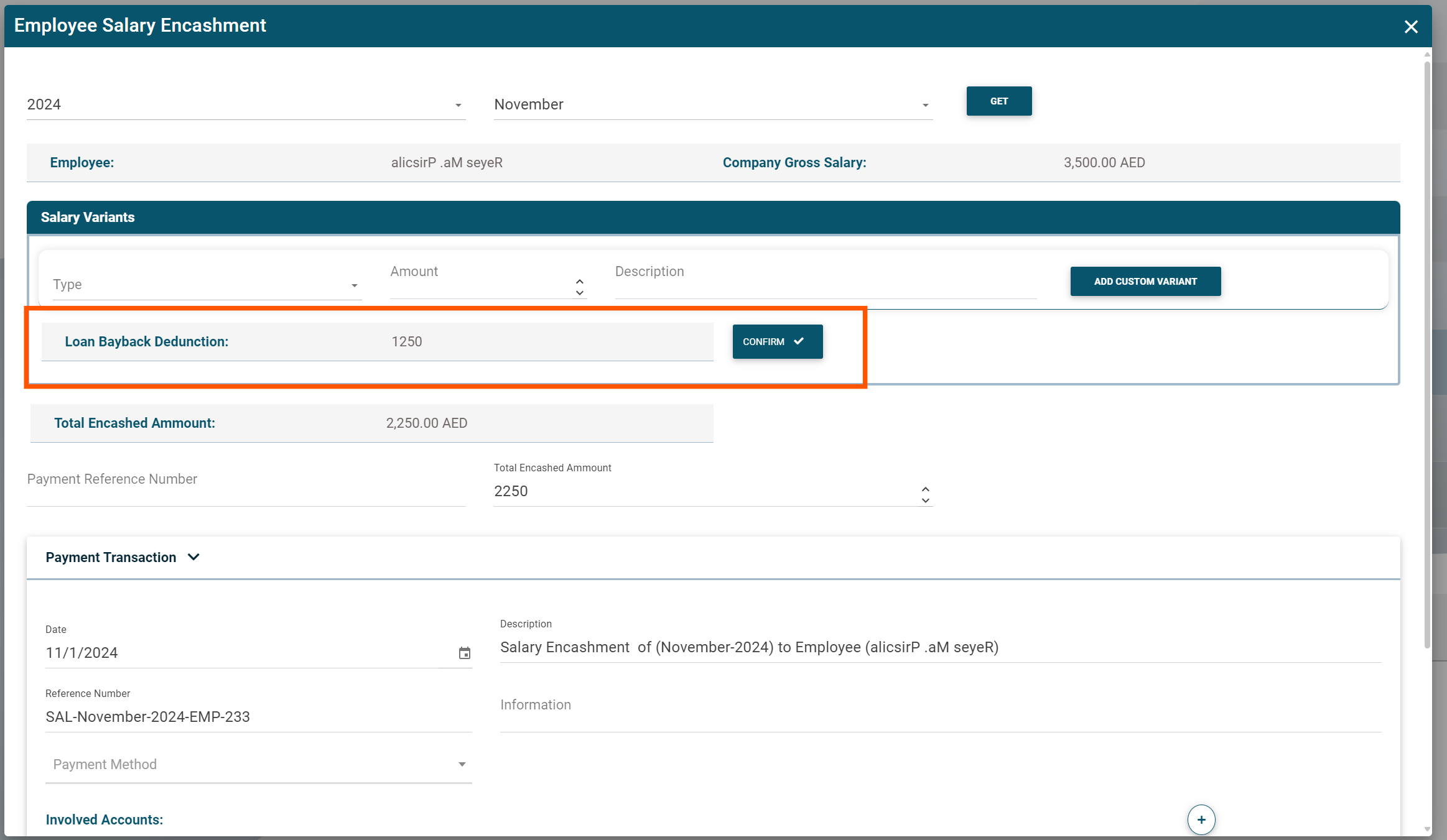

The system automatically deducts the monthly repayment amount from the employee's salary according to the approved loan terms. The loan status progresses as follows:

- Encashed: Monthly deductions are ongoing, reducing the outstanding balance.

- Paid Back: Once all deductions have been completed and confirmed by Accounting, the loan status changes to Paid Back. The employee can then apply for a new loan if desired.